This is what motivated me to finally implement changes in my life that led to paying off my debt and building emergency savings and retirement funds. Others, like the old me, might avoid checking their bank account altogether - the financial equivalent of sticking your fingers in your ears and shouting, "I can't hear you!" to anyone saying something you don't want to hear.įorcing myself to check my accounts daily made sure I always knew how much money I had, but more importantly, it got me into the mindset of always facing my finances head-on, no matter how potentially gruesome they were. They lie to themselves that they can pay it off next month when they know very well from the balance they've been carrying that that won't happen. Some might see they only have $5 in their bank account and still use their credit card to splash out on the latest tech gadget, even though they can't afford it. If you're stuck in the mindset that ignoring your financial problems will make them go away, they're only likely to get worse.įor folks who make enough money, on paper, to cover their living expenses, overspending is often the result of willful ignorance of one's own finances. The foundation for building good habits is to shift your mindset. You have to change your mindset to change your habits I even set my bank account login pages as my computer browser's homepage so when I open up my laptop to start work every morning, I can check in on my finances first. I keep mobile apps for each of my financial institutions on my phone's home screen for easy access. When developing a new habit, the best way to make sure it sticks is to make it easy. Doing so ensures that you always have an accurate picture of where your money is and can adjust your spending behavior in real time rather than after the fact.

#Should i balance my checkbook with online banking free#

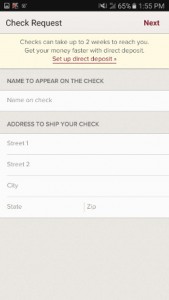

Now that we have free online checking accounts and mobile banking is ubiquitous, checking your bank account daily is an easy habit - not unlike balancing your checkbook. I know almost immediately if my account balance is dipping below where it should be, and I can adjust my spending accordingly. It takes five minutes, and it keeps me aware of how much I'm spending and where I'm at financially. What works is checking my bank accounts every day. I've tried dozens of methods for tracking my spending and keeping a budget, from spreadsheets to handwritten money journals to budgeting apps, but I never stick with them in the end. Unfortunately, now that we use debit and credit cards, most people swipe without thinking and rarely keep a consistent log of their expenses.

And consistently tracking their income and expenses was essentially the beginning of keeping a budget.Ĭonversely, not knowing how much money you have in the bank is the surest way to overspend. People who kept their checkbooks balanced always knew how much money they had in the bank. For those from younger generations reading this, balancing a checkbook involves writing down each expense and subtracting it from your overall bank account balance. Checking your bank account daily is the easiest way to stick to a budgetīack when Americans relied mostly on checkbooks for their daily spending, they made sure they never spent too much by balancing their checkbooks. How often? If your budgeting habits are anything like mine used to be, perhaps every day. There is one easy change you can make to help with both: Check your bank account more often. A good money mindset and solid financial habits are just as essential to healthy finances as a living wage. The term "lifestyle inflation" is just a fancy way of describing people who get into the habit of spending everything they earn and continue to do so even as their income increases. What's more, they don't necessarily lead to better savings habits if you have a flawed mindset towards money and spending.

But those are long-term changes that don't happen overnight. The most obvious ways to solve this problem are to seek higher wages and to lower your cost of living. And from the now oft-cited statistic that nearly 40% of Americans couldn't cover a $400 emergency without borrowing money to the fact that the majority of millennials - the oldest of whom are now approaching 40 - have nothing saved for retirement, it's clear that Americans also have a savings problem.Ĭredit card debt and lack of savings are both symptoms of the same problem: People are struggling to spend less than they earn. The average American cardholder is $6,028 deep in credit card debt, according to The Ascent's credit card debt study. More: Check out our best online checking accounts of 2022 America's debt and savings problem Save: Click here to uncover a best-in-class savings account that can earn you 14x your bank

0 kommentar(er)

0 kommentar(er)